Aprende en Comunidad

Avalados por :

¡Acceso SAP S/4HANA desde $100!

Acceso a SAPUnderstanding Multiple Valuation Approaches in SAP S/4HANA for Legal and Group Reporting

- Creado 01/03/2024

- Modificado 01/03/2024

- 1K+ Vistas

0

Cargando...

A transfer prices arises for accounting purposes, when one entity purchases goods from another entity within same group of companies. When two unrelated companies trade with each other, the price at which they undertake their transaction is simply known as “Price”. But when supply of goods and services is made to another related company, the price is called “transfer Price”

What you will understand from this blog Post?

A Multinational company operating in three countries have a requirement to determine the actual cost of goods manufactured for the group and does not include any intercompany profit and at the same time for legal reporting purpose require to include intercompany profit. This blog explained about how we can valuate inventory for different reporting purposes. In SAP S/4HANA Multiple valuation approaches /transfer prices functionality can manage up to three valuation approaches. This blog post covers two valuation approaches or views a) Legal View b) Group View

What is Multiple Valuation approach

Multiple valuation approach is the ability to value inventory in more than one valuation method.

This Approach required for:

Legal view

The legal view is the view of the individual enterprise that represents the transfers of goods and services between independent companies according to the legal reporting requirements

Group view

In the group view, the exchanged goods and services within affiliated companies determines the cost of good manufactured without including any intercompany profits.

Profit center view

In the profit center view, the exchanges of goods and services between profit centers are valuated using internal prices. In order to determine the profitability of those profit center and helpful for management to take pricing decision accordingly .

Business case:

In our example “Best Run” is a holding company with three legal entities the system represents the company codes LT02 located in Germany ,Company LT01 located in India and the company code LT03 located in US

The entity LT02 uses EUR as its local currency,LT01 uses INR as its local currency and LT03 uses USD as its local currency and all the three company code assign to the Controlling area “Best Run” LTP1 which uses the group currency EUR .The controlling area is assigned to an Operating concern called “Best Run” LTP1 with Accounting Based COPA ,its Currency EUR.

This session provides an configuration setting required for multiple valuation with in S/4 HANA environment

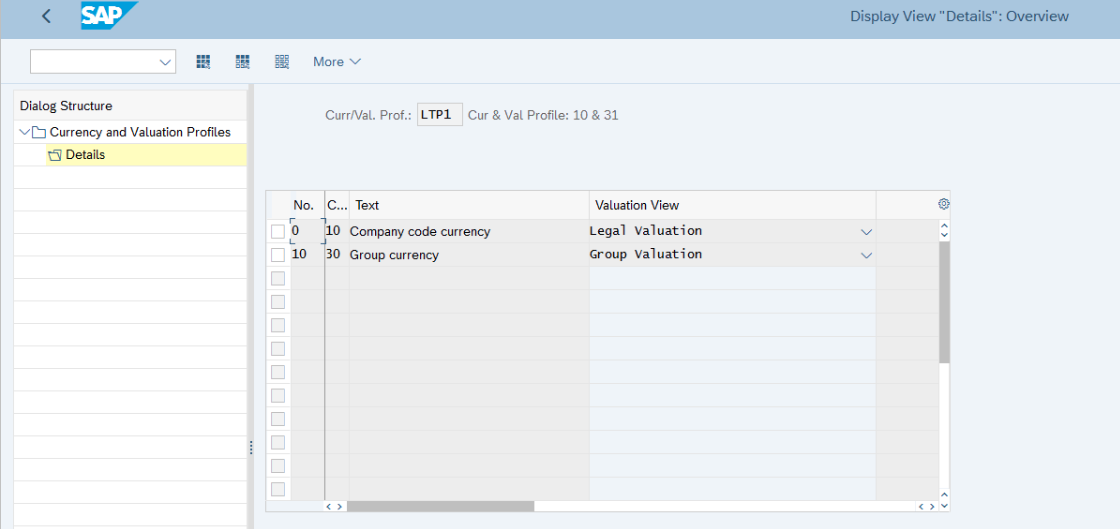

1.Creating a Currency and Valuation Profile:

The currency and valuation profile determine which valuations the system stores in which currency. Using standard, we can store up to three different valuation views in up to two different currency

To create valuation profile, follow the below steps:

Transaction 8KEM or follow the IMG menu Path Controlling --> General Controlling -->Multiple Valuation Approaches/Transfer Prices -->Basic settings -->Maintain Currency and Valuation Profile

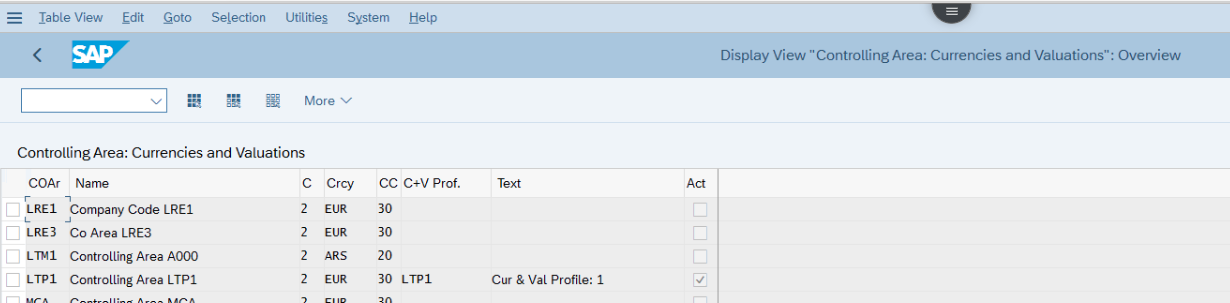

2. Assigning Currency and Valuation profile to Controlling area:

Assignment of the currency and valuation Profiles enable you to create actual version in CO for different valuation views. To assign the valuation profile to the controlling area, follow these steps:

Transaction 8KEQ or follow the IMG menu Path Controlling-->General Controlling -->Multiple Valuation Approaches/Transfer Prices --> Basic settings --> Assign currency and valuation profile to controlling area

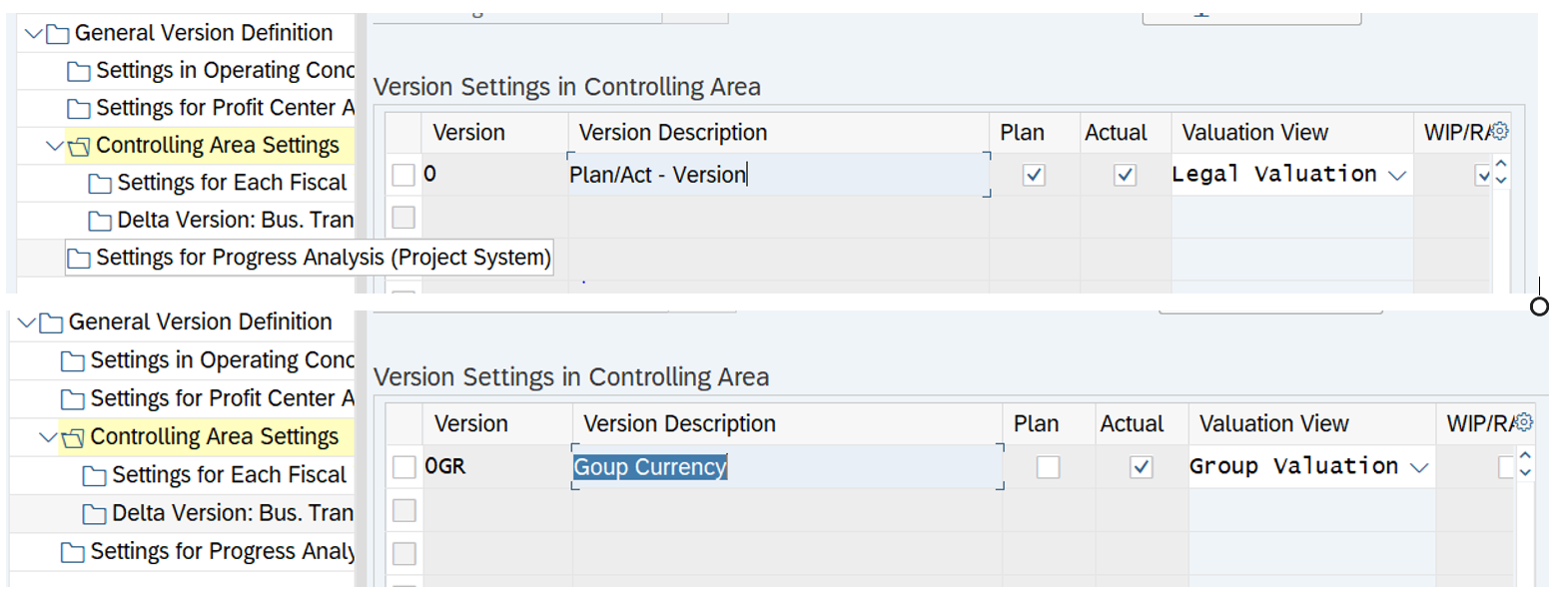

The multiple valuation approaches are stored in CO version in Controlling. If you use multiple valuation, the system used actual Version 0 for legal valuation and data of the parallel valuation stored in the delta version.

To create a delate version in CO, follow these steps

IMG menu path: Controlling -->General Controlling -->Organization -->Maintain version

4. Currency and Ledger settings in the Universal Journal

In the universal journal, multiple valuation approaches are managed in same way as parallel FI currencies. In SAP S/4HANA two options available to store multiple valuation.

What you will understand from this blog Post?

A Multinational company operating in three countries have a requirement to determine the actual cost of goods manufactured for the group and does not include any intercompany profit and at the same time for legal reporting purpose require to include intercompany profit. This blog explained about how we can valuate inventory for different reporting purposes. In SAP S/4HANA Multiple valuation approaches /transfer prices functionality can manage up to three valuation approaches. This blog post covers two valuation approaches or views a) Legal View b) Group View

- Introduction to Multiple Valuation approach

- Business Case

- Configuration Settings required for Multiple Valuation approach

- Scenario explained for business transaction

- Summary and Limitation in Multiple Valuation approach

What is Multiple Valuation approach

Multiple valuation approach is the ability to value inventory in more than one valuation method.

This Approach required for:

Legal view

The legal view is the view of the individual enterprise that represents the transfers of goods and services between independent companies according to the legal reporting requirements

Group view

In the group view, the exchanged goods and services within affiliated companies determines the cost of good manufactured without including any intercompany profits.

Profit center view

In the profit center view, the exchanges of goods and services between profit centers are valuated using internal prices. In order to determine the profitability of those profit center and helpful for management to take pricing decision accordingly .

Business case:

In our example “Best Run” is a holding company with three legal entities the system represents the company codes LT02 located in Germany ,Company LT01 located in India and the company code LT03 located in US

The entity LT02 uses EUR as its local currency,LT01 uses INR as its local currency and LT03 uses USD as its local currency and all the three company code assign to the Controlling area “Best Run” LTP1 which uses the group currency EUR .The controlling area is assigned to an Operating concern called “Best Run” LTP1 with Accounting Based COPA ,its Currency EUR.

This session provides an configuration setting required for multiple valuation with in S/4 HANA environment

1.Creating a Currency and Valuation Profile:

The currency and valuation profile determine which valuations the system stores in which currency. Using standard, we can store up to three different valuation views in up to two different currency

To create valuation profile, follow the below steps:

Transaction 8KEM or follow the IMG menu Path Controlling --> General Controlling -->Multiple Valuation Approaches/Transfer Prices -->Basic settings -->Maintain Currency and Valuation Profile

2. Assigning Currency and Valuation profile to Controlling area:

Assignment of the currency and valuation Profiles enable you to create actual version in CO for different valuation views. To assign the valuation profile to the controlling area, follow these steps:

Transaction 8KEQ or follow the IMG menu Path Controlling-->General Controlling -->Multiple Valuation Approaches/Transfer Prices --> Basic settings --> Assign currency and valuation profile to controlling area

The multiple valuation approaches are stored in CO version in Controlling. If you use multiple valuation, the system used actual Version 0 for legal valuation and data of the parallel valuation stored in the delta version.

To create a delate version in CO, follow these steps

IMG menu path: Controlling -->General Controlling -->Organization -->Maintain version

4. Currency and Ledger settings in the Universal Journal

In the universal journal, multiple valuation approaches are managed in same way as parallel FI currencies. In SAP S/4HANA two options available to store multiple valuation.

Pedro Pascal

Se unió el 07/03/2018

Facebook

Twitter

Pinterest

Telegram

Linkedin

Whatsapp

Sin respuestas

No hay respuestas para mostrar

Se el primero en responder

No hay respuestas para mostrar

Se el primero en responder

© 2025 Copyright. Todos los derechos reservados.

Desarrollado por Prime Institute

Hola ¿Puedo ayudarte?