Aprende en Comunidad

Avalados por :

¡Acceso SAP S/4HANA desde $100!

Acceso a SAPImplementación de Devolución de Débito Directo en SAP: Proceso y Configuración

- Creado 01/03/2024

- Modificado 01/03/2024

- 118 Vistas

0

Cargando...

Hello SAPers!

Here is my latest post, where I’d like to share some details about SAP’s functionality. It took me some time to prepare this post and it will take some time to read it through. I hope you will not regret this time. Please also check out my other posts.

Direct debit is a financial transaction, where the company sends the instruction to the bank to collect the payment directly from the debtor’s bank account. Properly implemented direct debit simplifies the debt collection for the company. This process is well described / documented. But as a rule, the documentation covers the regular process i.e., when the bank managed to collect the payment. Direct debit returns (cancellations / rejections) are not described properly. This post aims to fill this knowledge gap.

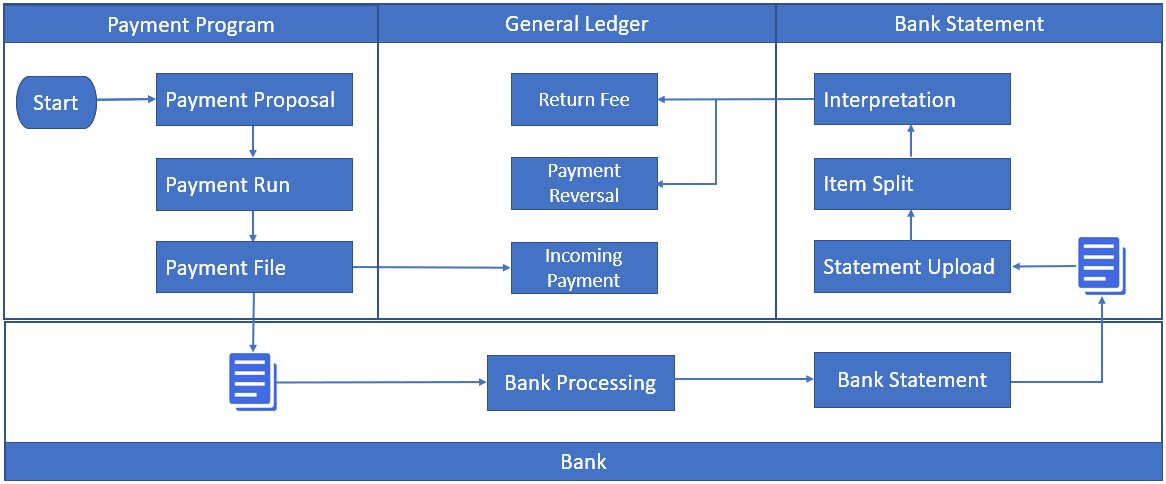

Screenshot below provides high-level overview of the process around direct debit:

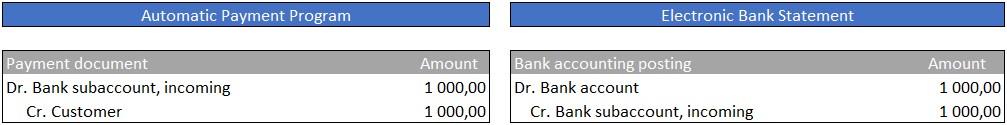

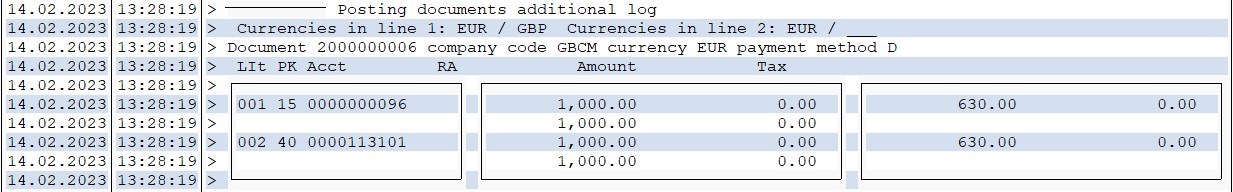

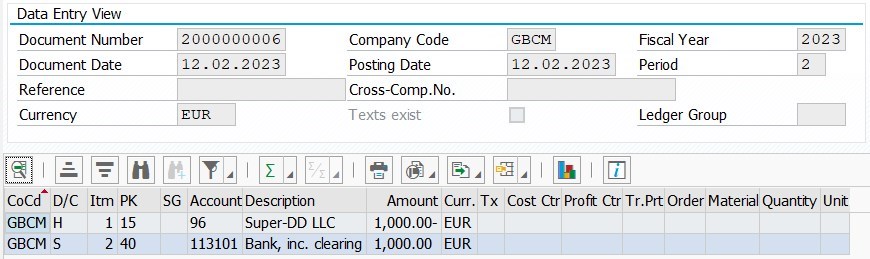

Direct debit is initiated in SAP via automated payment program (i.e., F110). The program generates the payment document that credits the customer account. This payment document automatically clears open items on customer’s account and generates an open item on clearing GL account for incoming bank payments. If everything goes fine, the bank will collect the payment from the customer and show the associated receipt in a bank statement. This is a simplified explanation, but I hope it provides a good explanation. Screenshot below provides an overview of the typical accounting postings.

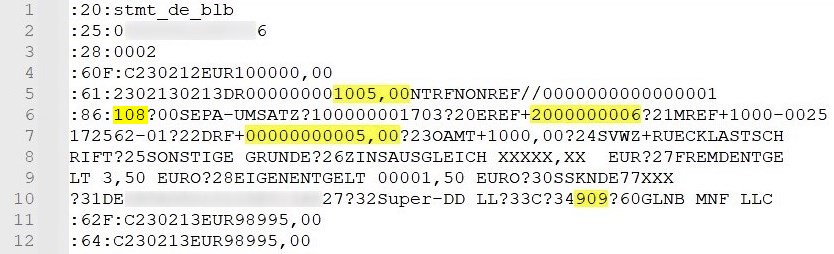

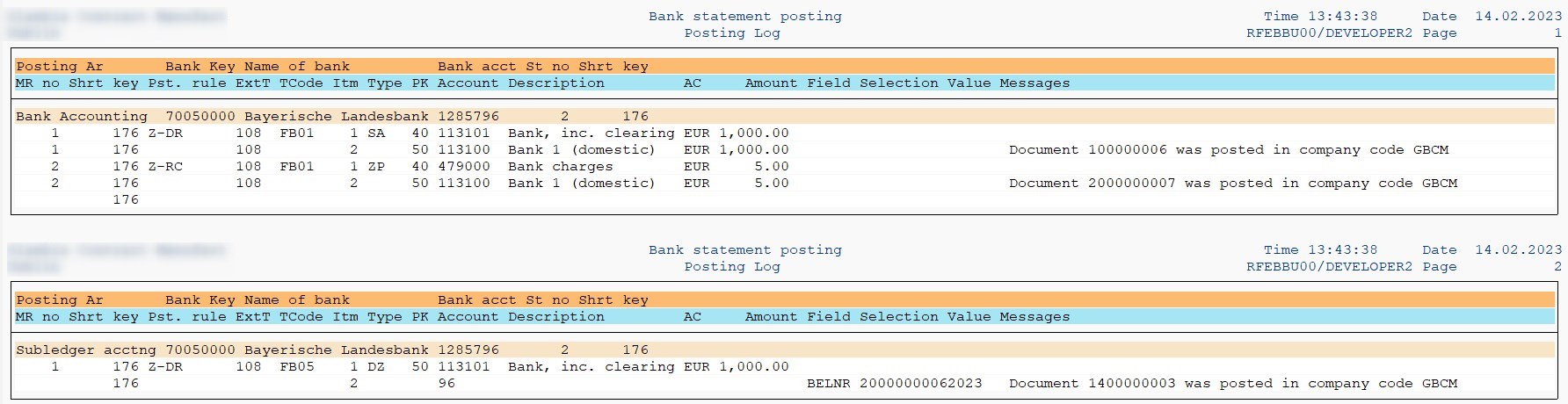

Let’s now consider the case of direct debit return. The return might happen due to a variety of reasons e.g., insufficient funds, incomplete / erroneous direct debit mandate etc. The bank charges a return fee for each operation. What is even more complicated, your bank might provide the information in bank statement in aggregated format i.e., operation amount (1005,00 EUR) will include the original payment amount (1000,00 EUR) + return fee (5,00 EUR). Screenshot below shows a sample bank statement with such aggregated operation.

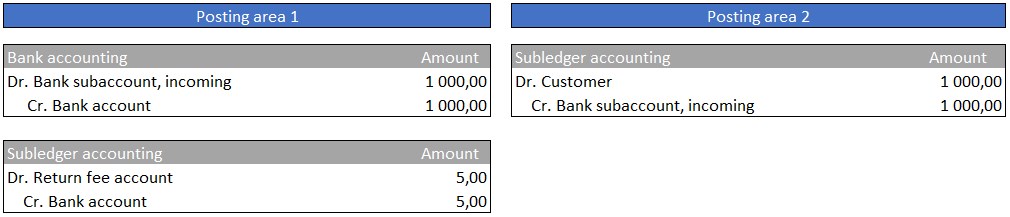

The screenshot below shows the expected postings in the bank statement with regards to direct debit return. Though we have only one line in bank statement, the system should be able to generate two separate postings:

Let’s see how this process can be implemented in the system.

Automatic payment program generated a payment document 2000000006 for total amount of 1000,00 EUR. This payment document number will be provided in the note to payee for the returned direct debit in the bank statement. See the example above, where this value is highlighted.

Screenshot of the payment document is provided below:

This payment run automatically cleared open item associated with the customer invoice 1800000007:

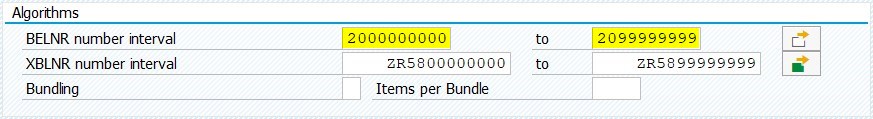

The interval of accounting document numbers should include the number range for payment documents. Screenshot below shows the appropriate selection screen block in the transaction FF_5.

If you work with S4 HANA system and use Fiori App F1680 “ Manage Incoming Payment Files ”, you’ll need to configure the parameter set, which stores the number ranges associated with bank statement. Please refer to my earlier post , that describes this configuration.

Screenshot below shows the import log associated with upload of this bank statement. As you can see, the program split one item into two different items, assigned different posting rules and automatically posted the documents in both posting areas.

As you can see, the log for the second posting area shows that the program identified original payment document 2000000006/2023. The clearing was reset automatically. Besides, as you can see, the report shows the open item for customer invoice 1800000007. This invoice was cleared during the payment run, but is re-opened now.

Here is my latest post, where I’d like to share some details about SAP’s functionality. It took me some time to prepare this post and it will take some time to read it through. I hope you will not regret this time. Please also check out my other posts.

Introduction

Direct debit is a financial transaction, where the company sends the instruction to the bank to collect the payment directly from the debtor’s bank account. Properly implemented direct debit simplifies the debt collection for the company. This process is well described / documented. But as a rule, the documentation covers the regular process i.e., when the bank managed to collect the payment. Direct debit returns (cancellations / rejections) are not described properly. This post aims to fill this knowledge gap.

Process Overview

Screenshot below provides high-level overview of the process around direct debit:

Direct debit is initiated in SAP via automated payment program (i.e., F110). The program generates the payment document that credits the customer account. This payment document automatically clears open items on customer’s account and generates an open item on clearing GL account for incoming bank payments. If everything goes fine, the bank will collect the payment from the customer and show the associated receipt in a bank statement. This is a simplified explanation, but I hope it provides a good explanation. Screenshot below provides an overview of the typical accounting postings.

Let’s now consider the case of direct debit return. The return might happen due to a variety of reasons e.g., insufficient funds, incomplete / erroneous direct debit mandate etc. The bank charges a return fee for each operation. What is even more complicated, your bank might provide the information in bank statement in aggregated format i.e., operation amount (1005,00 EUR) will include the original payment amount (1000,00 EUR) + return fee (5,00 EUR). Screenshot below shows a sample bank statement with such aggregated operation.

The screenshot below shows the expected postings in the bank statement with regards to direct debit return. Though we have only one line in bank statement, the system should be able to generate two separate postings:

- Direct debit return payment with 2 posting areas.

- Bank fee associated with direct debit return.

Let’s see how this process can be implemented in the system.

Process Flow in the System

Automatic payment program generated a payment document 2000000006 for total amount of 1000,00 EUR. This payment document number will be provided in the note to payee for the returned direct debit in the bank statement. See the example above, where this value is highlighted.

Screenshot of the payment document is provided below:

This payment run automatically cleared open item associated with the customer invoice 1800000007:

The interval of accounting document numbers should include the number range for payment documents. Screenshot below shows the appropriate selection screen block in the transaction FF_5.

If you work with S4 HANA system and use Fiori App F1680 “ Manage Incoming Payment Files ”, you’ll need to configure the parameter set, which stores the number ranges associated with bank statement. Please refer to my earlier post , that describes this configuration.

Screenshot below shows the import log associated with upload of this bank statement. As you can see, the program split one item into two different items, assigned different posting rules and automatically posted the documents in both posting areas.

As you can see, the log for the second posting area shows that the program identified original payment document 2000000006/2023. The clearing was reset automatically. Besides, as you can see, the report shows the open item for customer invoice 1800000007. This invoice was cleared during the payment run, but is re-opened now.

Pedro Pascal

Se unió el 07/03/2018

Facebook

Twitter

Pinterest

Telegram

Linkedin

Whatsapp

Sin respuestas

No hay respuestas para mostrar

Se el primero en responder

No hay respuestas para mostrar

Se el primero en responder

© 2026 Copyright. Todos los derechos reservados.

Desarrollado por Prime Institute

Hola ¿Puedo ayudarte?