Aprende en Comunidad

Avalados por :

¡Acceso SAP S/4HANA desde $100!

Acceso a SAPDiferencias entre los Informes de Actividad Comercial (BAS) y los Informes de Cajas en SAP Business One

- Creado 01/03/2024

- Modificado 01/03/2024

- 19 Vistas

0

Cargando...

Business Activity Statement (BAS) Report and Box Reports are two similar reports in SAP Business One. In this article, I want to describe how BAS Reports differ from Box Reports.

BAS (Business Activity Statement) Reports are a feature that you can find in almost all localizations of SAP Business One that support VAT groups (e.g. in Poland, France, UK, Switzerland, Austria, Czechia but not in Germany).

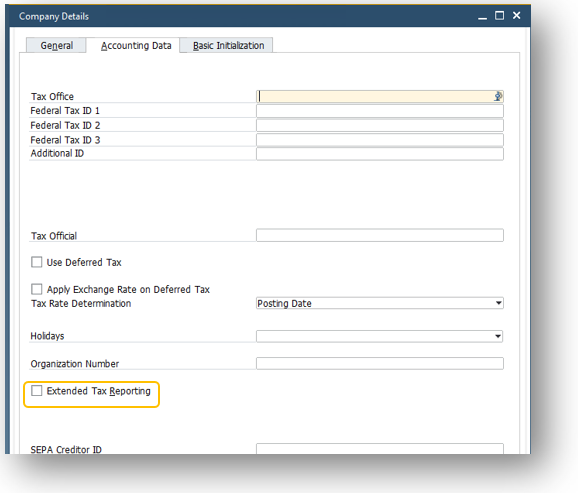

If you cannot find BAS Reports in SAP Business One, check that you have activated the functionality in Company Details → Accounting Data by selecting the Extended Tax Reporting check box:

Please note that enabling Extended Tax Reporting changes how tax functionality works. So, we recommend that you learn more about the functionality by using your demonstration database first.

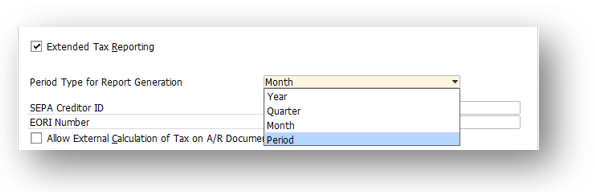

You will need to define the Period Type in which you send your VAT reports to the tax authorities:

The first three options correspond to the calendar year; the last option Period corresponds to the posting periods that are set up in your SAP Business One database. I will provide more details later in this article.

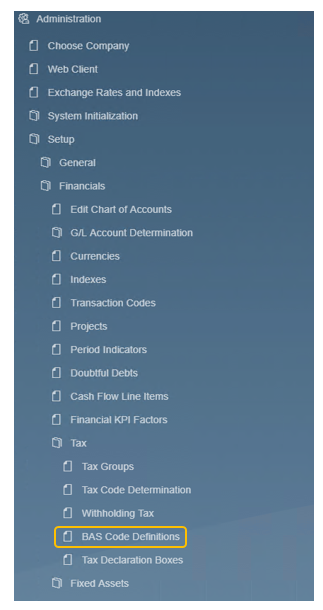

After you have enabled BAS reporting, you need continue with BAS Code Definitions:

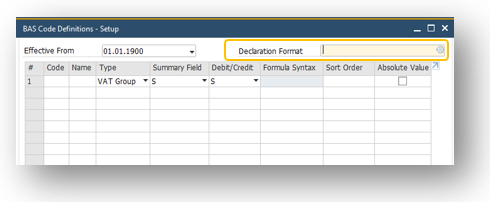

Although the BAS Code Definitions – Setup window looks similar to Tax Declaration Boxes – Setup window, there are differences in both forms and the later reports.

The first difference is that you can define the file format for the report:

You can choose a relevant option for the period frame file from the List of Legal List Formats (you need to first upload the file in the Electronic File Manager under Administration → Setup → General ).

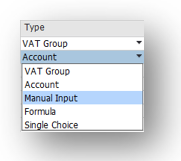

The second difference is that you can define boxes with type Account , Manual Input and Single Choice that are not available in Tax Declaration Box – Setup :

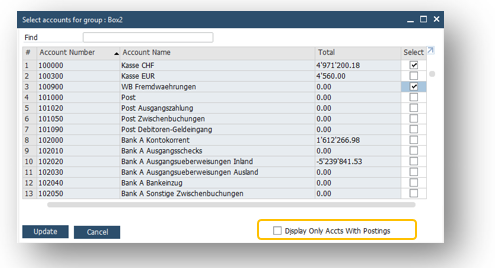

If you choose Account type, the Summary Field is not taken into the consideration and SAP Business One takes the default value as Base Amount , which cannot be changed. By double-clicking on the row or using the BAS Code Definitions - Rows button, you can define one or several accounts for the box. You can narrow your selection by selecting the Display Only Accts With Postings checkbox:

There are no limitations to account selection in this form; you can choose a Control account, a Cash account or an account used for VAT postings.

For a box with Manual Input type, you do not need to define a Summary Field , Debit/Credit or anything else. You can type a value into the report when generating it.

For a box with Single Choice , the Summary Field and Debit/Credit are not relevant. The difference between Manual Input and Single Choice is that the administrator can set valid values for the box. It can be very convenient if you need to provide specific codes for some business operations in your file. You can define the codes in the same way as for other boxes by double-clicking on the or by selecting the BAS Code Definitions – Rows option.

In the Formula type box, you can define operations for the already defined boxes almost in the same way as in the

BAS (Business Activity Statement) Reports are a feature that you can find in almost all localizations of SAP Business One that support VAT groups (e.g. in Poland, France, UK, Switzerland, Austria, Czechia but not in Germany).

If you cannot find BAS Reports in SAP Business One, check that you have activated the functionality in Company Details → Accounting Data by selecting the Extended Tax Reporting check box:

Please note that enabling Extended Tax Reporting changes how tax functionality works. So, we recommend that you learn more about the functionality by using your demonstration database first.

You will need to define the Period Type in which you send your VAT reports to the tax authorities:

The first three options correspond to the calendar year; the last option Period corresponds to the posting periods that are set up in your SAP Business One database. I will provide more details later in this article.

After you have enabled BAS reporting, you need continue with BAS Code Definitions:

Although the BAS Code Definitions – Setup window looks similar to Tax Declaration Boxes – Setup window, there are differences in both forms and the later reports.

The first difference is that you can define the file format for the report:

You can choose a relevant option for the period frame file from the List of Legal List Formats (you need to first upload the file in the Electronic File Manager under Administration → Setup → General ).

The second difference is that you can define boxes with type Account , Manual Input and Single Choice that are not available in Tax Declaration Box – Setup :

If you choose Account type, the Summary Field is not taken into the consideration and SAP Business One takes the default value as Base Amount , which cannot be changed. By double-clicking on the row or using the BAS Code Definitions - Rows button, you can define one or several accounts for the box. You can narrow your selection by selecting the Display Only Accts With Postings checkbox:

There are no limitations to account selection in this form; you can choose a Control account, a Cash account or an account used for VAT postings.

For a box with Manual Input type, you do not need to define a Summary Field , Debit/Credit or anything else. You can type a value into the report when generating it.

For a box with Single Choice , the Summary Field and Debit/Credit are not relevant. The difference between Manual Input and Single Choice is that the administrator can set valid values for the box. It can be very convenient if you need to provide specific codes for some business operations in your file. You can define the codes in the same way as for other boxes by double-clicking on the or by selecting the BAS Code Definitions – Rows option.

In the Formula type box, you can define operations for the already defined boxes almost in the same way as in the

Pedro Pascal

Se unió el 07/03/2018

Facebook

Twitter

Pinterest

Telegram

Linkedin

Whatsapp

Sin respuestas

No hay respuestas para mostrar

Se el primero en responder

No hay respuestas para mostrar

Se el primero en responder

© 2025 Copyright. Todos los derechos reservados.

Desarrollado por Prime Institute

Hola ¿Puedo ayudarte?